Flooding is on the rise and impacting Canadians everywhere

Once a homeowner discovers a flood in their basement, they tend to never forget the experience. Yes, the financial costs incurred can be devastating, especially to the uninsured, considering the average cost of a flood claim in Canada is $43,000. However, the homeowner will also pay a price in terms of their mental health. For many, the time and effort spent on repairs and restoration are compounded by stress and worry.

Unfortunately, those stressful feelings often linger, long after the restoration process has ended. According to a study conducted by The University or Waterloo’s Intact Centre on Climate Adaptation, 47 percent of respondents revealed that even after three years post-flood, they still worry every time it rains. To mitigate financial and emotional damage consider basement flooding prevention techniques before the winter storm season sets in.

Basement flooding prevention

Canada’s climate is changing. We are seeing more and more extreme weather, and it’s getting harder to imagine our climate miraculously reverting back to its original form. With severe weather conditions comes flooding, and many Canadians have felt the impact of water damage. Forty-nine percent of all insurance claims in Canada are flood claims. For those of us who have yet to experience a basement flood, we should consider ourselves to be fortunate; we haven’t had to cope with such a stressful life event, and we are afforded the luxury of time right now to make sure we are properly prepared and covered should it happen to us.

Not adapting to climate change is not an option

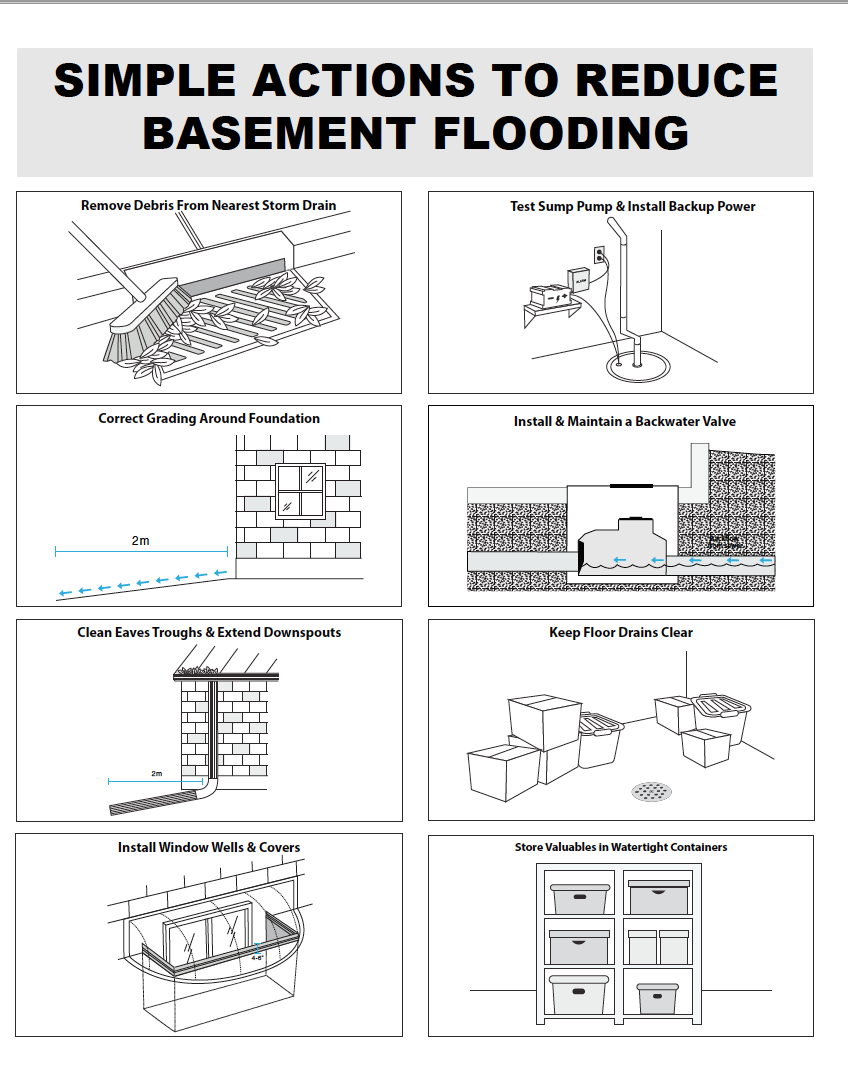

The mandate of the Intact Centre on Climate Adaptation involves working with homeowners, communities and the government to identify and reduce the impact of extreme weather and climate change. According to the Intact Centre, not adapting is not an option. Homeowners need to incorporate flood prevention into their household maintenance plan, especially now, as winter is approaching. A properly maintained home helps basement flooding prevention.

Self-Inspection for basement flooding prevention

Every six months perform a visual inspection for any signs of water damage around sinks, bathtubs, showers, hot water tank and washing machines. Consider installing water detector alarms/ leak sensors in these areas. Also inspect appliance hoses. Look for kinks, weak spots and wear and tear. Upgrade any bad hoses with good quality, steel braided, replacement hoses.

Educating family members/tenants

Ensure all occupants of your household have a clear understanding of what is safe and not safe to be washed or flushed down the drain. Also, demonstrate how to shut off the water to family members and/or tenants.

Professional inspection

Do you think your plumbing might be outdated? Have your pipes checked. Plumbers will also look for tree roots growing too close to your pipes and nearby sewers. They can check for any growing blockage within the pipes. Are there leaks in your roof? Have a roof inspection performed, especially after a storm. Don’t hesitate to address any issues found. As the saying goes, a stitch in time saves nine.

Day-trippers and snowbirds

An unexpected leak or broken hose can release approximately 650 gallons of water each hour. Before leaving on that weekend getaway, shut off the water. Flying south for the winter? Make sure your home is prepared for your absence. Having someone check on your home daily during your winter vacation is the ideal solution, but that’s not always going to be a viable option. The next best solution would be to shut off the water, drain the pipes, and drain any water appliances including the hot water tank and any outside taps.

Document contents and do an image inventory

Everything in your basement has a value. Having an itemized list of the contents, up-to-date photos and corresponding purchase receipts stored in a safe, dry place will definitely help the claims process flow more smoothly, should a flood occur.

Review and understand your insurance coverage

Damaging water can enter your home in a variety of ways. Overland insurance coverage offers homeowners protection during a flooding event where the water flows overland, spilling into the home via cracks and openings. Sewer back up protection covers homeowners in the event of backed up sewer water entering the home through the basement pipes and drains, often occurring after heavy rains. Roof leaks, faulty plumbing, flooding via neighbouring units in condo and town-home developments all can be sources of unwelcomed water. Not only do homeowners need the correct insurance coverage, but they must also have a clear understanding of what’s covered and not covered, how much the deductible is, and specifics like whether the homeowner’s policy allows the option to use their own contractor for the restoration in the event of a basement flood. If you still have questions about your policy, your insurance provider is always just a phone call away.

For more information on flooding, and the Intact Centre for Climate Adaptation

https://www.intactcentreclimateadaptation.ca/

https://insureye.com/home-insurance-claims-in-canada-2017-study-tips-for-you/

Reliance Insurance proudly serves

Burnaby and the Vancouver area