While Canada’s inflation rate is on the decline, a puzzling question persists: Why do insurance premiums continue to rise? Despite the downtrend in inflation, the Property and Casualty market remains stubbornly hard.

Intact CEO Charles Brindamour highlights the ongoing presence of several conditions that support this hard market trend well into the foreseeable future. The industry grapples with challenges like inflation, reinsurance costs, global instability, and the aftermath of continuous catastrophic natural disasters.

Over the past decade, a slew of new factors have emerged in the Canadian market. Instances like the Toronto floods, devastating fires obliterating communities like Fort McMurray, AB and Lytton, BC and massive hurricanes in Eastern Canada have all impacted the surge in insurance premiums. Traditionally, Canada had not mirrored the global market’s high and low trends, but this paradigm shifted notably in 2022. Let’s explore why insurance premiums are on the rise.

The surge in insurance premiums can be attributed to several headwinds:

Inflation

On August 6, 2023, Deputy Prime Minister and Finance Minister Chrystia Freeland hailed the 2.8% June inflation rate as a milestone moment, reaching the target range for the first time in more than two years.

However, according to CTV News, recent article – Extreme weather risk changing Canada’s insurance industry, raising costs – Statistics Canada’s recent inflation report revealed an 8.2 percent rise in national home insurance costs in June compared to the previous year. Alberta, British Columbia, and Saskatchewan witnessed increases of about 10 percent, while Nova Scotia faced nearly a 12 percent surge. Despite cooling inflation, insurance prices are not dropping; rather, the rate of price increases is moderating.

Extreme weather and climate change

Canada is one of the nations most impacted by climate change in terms of insurance risks, according to the Insurance Bureau of Canada. Wildfires and floods inflict significant impacts on property insurance costs due to heightened risks and the potential for greater claims. In 2023, Canada experienced its most severe fire season on record, followed by massive flooding in areas like Nova Scotia.

These natural disasters wreak havoc on homes and properties, leading to increased insurance payouts and subsequent adjustments in premiums.

Additionally, inflation has impacted escalating replacement costs, liability coverage, and business interruption insurance, contributing to the rise in insurance rates.

Supply chain ramifications from the pandemic

Despite the pandemic receding, supply chain bottlenecks persist across all sectors. Labour shortages, shipping container inventory issues, distribution interruptions, and constraints in warehousing space and management have created a perfect storm. Global events have induced inflationary pressures on commodities, raw materials, construction supplies, and crucial goods like computer chips and semiconductors, all of which affects the supply chain and consequently insurance premiums.

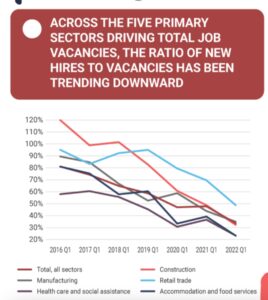

Wage inflation, labour shortages and Canada’s inflation rate

As the overall cost of living rises, employees demand higher wages, indirectly influencing payroll expenses for businesses. This in turn has an impact on the price of training, healthcare, and workers’ compensation insurance. Canada’s insurance industry is likewise experiencing a significant labour shortage because of pandemic-related retirements and departures, which are being slowly replaced by a slow influx of newcomers into the industry. Info graphic supplied by Stats Canada.

Reinsurers’ impact on prices

According to investopedia.com, a reinsurer is a company that provides financial protection to insurance companies. A reinsurer handles risks that are too large for insurance companies to handle on their own and makes it possible for insurers to obtain more business than they would otherwise be able to.

Furthermore to inflation, global reinsurance companies have reassessed Canada’s risk profile, leading to substantial price hikes, as stated by Craig Stewart, VP of Climate and Federal Affairs for the Insurance Bureau of Canada. Reinsurers have increased their pricing by 25% to 100% over the past year, and some of these price hikes have trickled down to end consumers. Commercial lines have seen increases of 25 percent or more, as reported by Fitch Ratings.

Investment returns

Insurers typically invest the premiums they collect to generate income for future claims. Inflation’s influence on investment returns can impact insurers’ overall financial health. To sustain profitability and financial stability, insurers may adjust premium rates in response to investment performance affected by inflation. Although insurance companies managed to break even in 2022, the property and casualty insurance industry’s overall profitability suffered due to inflation’s impact on diminishing investment income and other comprehensive income.

Will insurance prices go down? Or is the hard market here to stay?

It remains unclear whether insurance premiums will go down or if the challenging market will continue in 2023. This hard market maybe the outcome of “the perfect storm” resulting from various factors impacting markets globally. Simply put, insurance rates go up when losses go up. And the losses over the last few years have been massive.

The role of the broker in a hard market

“At Reliance Insurance, we have an innovative approach to helping our commercial clients mitigate their loss ratios. With the hard market factors in play currently, it is our duty to work with each client to make sure they have the coverage they need, at a price they can afford. And that sometimes takes innovative and creative approaches to commercial insurance coverage,” reports Jim Ball, President of Reliance Insurance Agencies.

The surge in insurance premiums is influenced by a multifaceted interplay of elements, encompassing economic conditions, climate change ramifications, regulatory shifts, historical loss data, and industry competition. Moreover, insurers factor in policyholders’ claims histories, risk profiles, coverage limits, and an

array of other considerations when determining premium rates.

For additional resources related to insurance and Canada’s inflation rate, please refer to:

AP News: How busy will Atlantic hurricane season by?

Canadian Underwriter: What’s the future for Canadas reinsurance rates?

Canadian Underwriter: Why Brokers still need to protect clients from inflation.

Reliance Insurance proudly serves

Burnaby and the Vancouver area