Co-insurance is a crucial concept frequently encountered in property insurance policies. It is essential for property owners in Canada to grasp the implications of commercial property co-insurance clause, as the terms and conditions of property insurance can vary among providers and policies.

If there is an insurance claim for partial or total loss, the policyholder effectively becomes a co-insurer, which means they would share in the loss. Co-insurance penalties are, therefore, dependent on the co-insurance percentage stipulated in the contract. While they are most commonly 80% or 90%, they could be lower or higher than this.

Here’s a breakdown of how co-insurance works:

- Insurance policy limit: When you buy property insurance, you specify a policy limit. This limit represents the maximum amount the insurance company will pay out in the event of a covered loss, such as property damage or destruction.

- Co-Insurance percentage: Your insurance policy may specify a co-insurance percentage, often set at 80% or 90%. This percentage represents the minimum coverage you should have compared to the actual replacement cost of your property.

- Replacement cost: The actual replacement cost is the estimated cost of rebuilding or replacing your property with materials of like kind and quality. It is crucial to have an accurate assessment of this value.

- Actual cash value or depreciated value is the value of your property as it stands now, considering its current age and condition.

- The gold standard determination of either the replacement cost or depreciated value of your property is an appraisal by an accredited appraisal company.

Now, let’s delve into what is a commercial property co-insurance clause.

The co-insurance penalty:

- If your insurance coverage falls below the required co-insurance percentage (e.g., you have 70% coverage when the policy stipulates 80% co-insurance), you may face a co-insurance penalty.

- In the event of a claim, the insurance company calculates the loss based on the ratio of your actual coverage to the required coverage. For instance, if you experience a $100,000 loss and have only 70% of the necessary coverage, the insurance company might pay only 70% of the claim, which would be $70,000.

- Consequently, you would be responsible for the remaining 30% of the loss, totaling $30,000 out of your pocket.

The importance of insuring to replacement cost or depreciated value

The purpose of co-insurance is to encourage property owners to adequately insure their properties to prevent underinsurance in case of significant losses. It is imperative to thoroughly review your property insurance policy, comprehend the co-insurance clause, and ensure you have sufficient coverage to avoid potential penalties when filing a claim. If you have any doubts or questions regarding co-insurance, it is advisable to consult with your insurance provider or a professional insurance advisor to ensure your property is adequately protected.

In summary, while you may believe your property won’t suffer a total loss, but partial substantial losses can still be costly. Insuring your property to its proper replacement cost or depreciated value eliminates these potential problems and safeguards your financial exposure. Therefore, it is highly recommended that any commercial property owner insures the property to its replacement cost or depreciated value depending on your intention after a total loss.

Furthermore, insuring your property to its replacement value or deprecated value is the foundation of protection. Failing to do so can result in under insurance and the imposition of a Co-Insurance Penalty. For example, let’s consider an older commercial building in Vancouver currently insured for $15,000,000. However, a recent construction appraisal indicates its replacement cost is $22,000,000, and the policy stipulates a 90% co-insurance clause, requiring coverage of no less than $19,800,000.

In the event of a loss, the following formula would apply: The policy would pay the determined amount as follows – $15,000,000 (insured amount) divided by $19,800,000 (required amount) equals 75% times the loss amount.

It’s important to note that in case of a total loss, the policy would cover the full amount ($15,000,000). However, for partial losses, such as a $4,000,000 loss, the policy would pay $3,000,000, and your contribution would be 25%, or $1,000,000.

Full example of co-insurance penalty calculation

Let’s consider a real-life inspired example to illustrate how a co-insurance penalty might apply in the case of a partial building loss in Vancouver:

Partial building loss due to fire

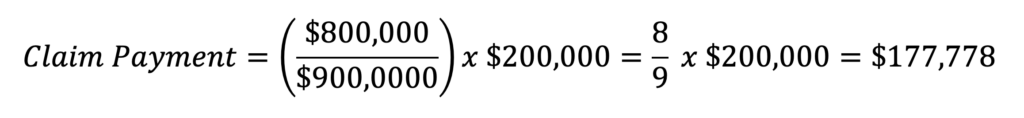

- Property Value: $1,000,000

- Insurance Coverage Required (Co-Insurance Clause): 90%

- Actual Insurance Purchased: $800,000

- Amount of Loss: $200,000

- Co-insurance penalty $22,2222

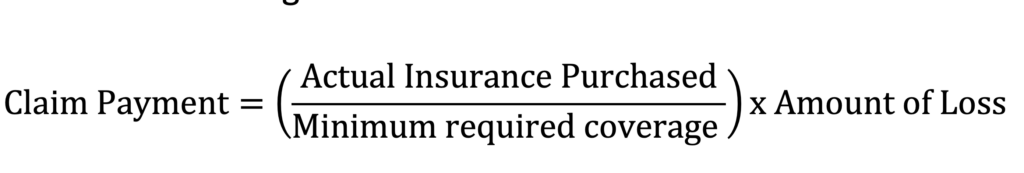

Formula for calculating co-insurance coverage:

Substituting the values:

Therefore, due to the co-insurance penalty, the policyholder would receive approximately $177,778 for their $200,000 loss, rather than the full amount. The co-insurance penalty, in this case, is about $22,222, which is the difference between the loss amount and the reduced claim payment due to underinsurance.

This example highlights the importance of adequately insuring property to the levels required by the commercial property co-insurance clause to avoid penalties in the event of a loss.

Resources:

Colliers Canada: Building Appraisal Services

Reliance Insurance proudly serves

Burnaby and the Vancouver area