It’s hard to overstate the level of damage that water can do to your business. Water is easily the most pervasive offender when it comes to risks to your business – 51% of property insurance claims in Canada stem from water, and with the value of water damage claims steadily rising, smart business owners are taking steps to manage their insurance costs by proactively protecting themselves and their businesses.

The impact of climate change on business

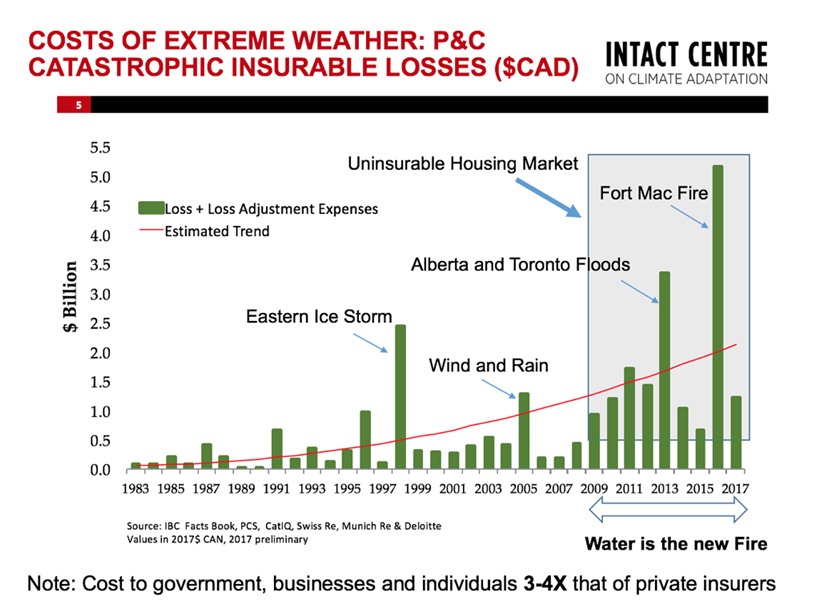

According to research conducted by the Intact Centre for Climate Change at the University of Waterloo, climate change is real and irreversible. Whereas fire was the main insurance claim, water damage has now exceeded those claims and is exponentially on the rise. The costs of extreme weather and catastrophic losses totaled $5.5 billion in 2017, compared to $2.5 billion resulting from the 1998 Eastern Ice Storm, which was the highest loss since 1983. With this reality, Canadians need to fully understand the risks and have adequate knowledge to adapt. Small business owners can not afford to be “out of business” for even a few days due to flooding.

Resource: Intact Centre for Climate Adaptation, Flood Risk in the Rise presented by Natalia Moudrak

Taking precautions can save your business

Flooding does not have to mean a river overflowing, flooding can be caused by extreme melting or rainstorms. There are many ways that water can cause problems, and just as many ways to proactively protect your building from them. Here are a few:

Sewer Leak: When the pipes are blocked or the sewer is beyond its capacity, sewage is pushed out into your toilets, sinks or floor drains. You can protect your property against this by having your pipes checked annually for invasive roots, ensuring that nothing goes down the drain that might block the pipes over time, such as grease, or taking the extra step of having a backwater valve installed on your pipes. And because sewer backup develops gradually, having a plumber check your pipes annually can save you a great deal of time and money down the road.

Many insurers have discounts for where backwater valves and other preventative measures are installed

Building Structure: Your roof, windows, and walls are the backbone of your commercial property, but they need to be monitored to ensure that water isn’t compromising their ability to house your business. Standing water, often masked by landscaping or bushes, can cause your exterior walls to deteriorate, and moisture caused by leaky windows and roofs often leads to mould or puddled water in your building. The most effective way to protect the structure of your building is to conduct regular, scheduled assessments of your roof, external walls, and windows to address any issues before they become significant, as well as ensuring that bushes and soil are well away from the building.

HVAC/Water Heater: Your heating systems need to be monitored as well. The HVAC works by collecting moisture, but this can backfire if the collection systems are faulty or failing, causing mold and water damage. This risk increases with your hot water tank – when the lining of the tank erodes over time, the water held within the tank can leak, or worse, be released completely. Both systems require careful, regular checks, and professionals recommend that your water tank should be replaced every 10 years.

Be prepared

The secret weapon that will ultimately protect your business from water damage is a clearly laid out mitigation plan that outlines emergency procedures in the case of a building leak, so that water damage is minimized. Your plan should include:

- A map that shows the location of water shut off valves, and instructions on how to turn them on and off

- An evacuation plan

- Instructions regarding sprinkler systems

- An up-to-date emergency contact list with both internal and external contacts

- Copies of all critical hardcopy documents kept offsite/online

There’s no point in having a water damage mitigation plan if no one understands it, so make sure that it is well communicated, and that your employees are trained on how to address emergency water issues, just as you have prepared them for fire or earthquakes.

Insurance has your back and your commercial property

Proactively planning for water problems at your property will help you avoid or contain the inevitable damage, but the final step is having a well-crafted insurance policy to back you up so that if a water emergency happens to your business, you can protect your bottom line, and get back to serving your customers as soon as possible. Talk to the experts at Reliance Protection about commercial property insurance and how it can support you when water damage affects your business.

Note: The Intact Centre on Climate Adaptation is working on a program on flood protection and proofing for commercial real estate buildings. We will share the information as soon as it is available. Other related recent publications are available: https://www.intactcentreclimateadaptation.ca/news/recent-reports/

Additional Insurance Information

Reliance Insurance proudly serves

Burnaby and the Vancouver area