How to save on earthquake insurance deductibles. In BC, we are at a higher risk of having an earthquake. To ensure your valuable assets are adequately protected, Reliance Insurance highly recommends adding an earthquake endorsement which will provide coverage for your home, personal belongings and your outbuildings. Depending on your insurance company, the earthquake endorsement may also cover the cost of bringing your home up to current building codes during the repair process, as well as other expenses like debris removal and additional living expenses. An earthquake endorsement usually comes with a hefty deductible, but with an earthquake, deductible buy down policy, earthquake insurance can be affordable, offering the best coverage and peace of mind.

What does earthquake insurance cover?

A standard homeowner’s policy may cover fire damage that results from an earthquake, but an earthquake policy is important to cover damage that results from water and/or shaking, such as structural damage or collapse. Earthquake insurance policies cover damage to your house and your belongings, up to the insured amount. You’ll want to buy enough to replace your belongings and to cover the cost of rebuilding your home.

How much does earthquake insurance deductibles cost?

Reliance Insurance can provide an Earthquake Deductible Buy-Down Insurance policy that offers a reduced deductible, which will allow the claims process to begin sooner in the event of an earthquake.

Because of the massive potential risk associated with an earthquake in British Columbia, coverage tends to be expensive. Your premium amount will depend on the structure and age of your home and the location. Homes on the West Coast of BC may have higher premiums compared to homes located in the interior. In addition, earthquake policies include a percentage deductible, generally ranging from 2% to 20% of total damages, which means you’ll still have significant out-of-pocket costs in the event of an earthquake.

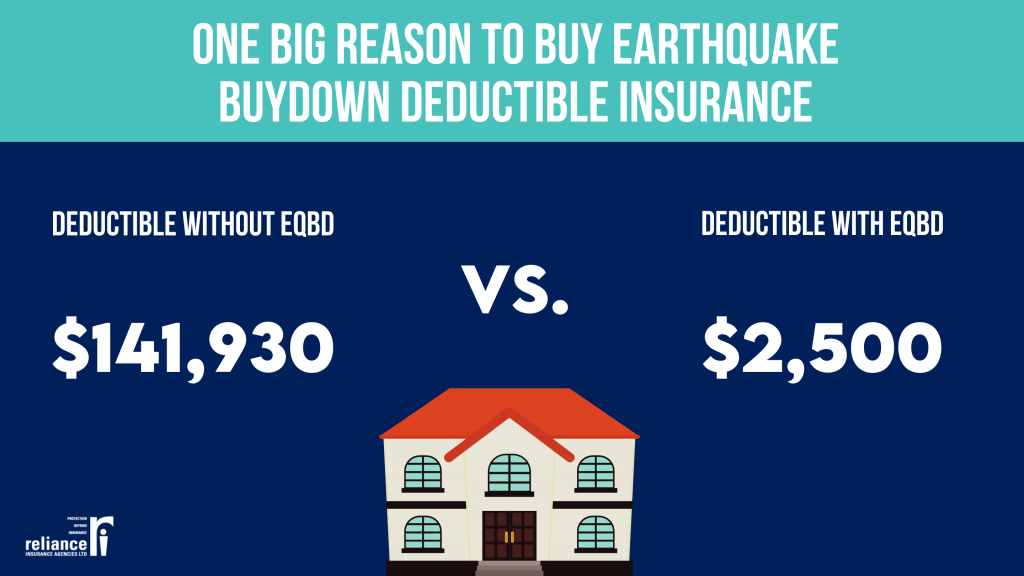

It is important to understand how an earthquake insurance deductible is calculated. Depending on the value of your home and dwellings, deductibles can be over $100,000. Many policyholders will struggle to pay their earthquake deductible when the coverage is needed without earthquake deductible insurance.

You’ll want to weigh the cost against your perceived risk of experiencing an earthquake, and your ability to survive the financial aftermath of such a catastrophic event. In assessing your risk, it’s important to know that the government typically will not provide much financial aid for earthquake victims, and help may be limited to low-interest loans that you will need to repay.

Benefits of buying earthquake deductible insurance with Reliance Insurance

- Affordable premium and deductible, making earthquake Insurance more accessible

- Flexibility – you can choose a limit to cover the deductible up to $500,000, or just a portion of your earthquake deductible buy down an earthquake deductible to 10%, 5% or 3%

- Quotes include a premium split per unit owner per month, for multi-unit buildings

- Protects your financial security

Property deductibles can be complex and often confusing. Our recommendation is to talk to your Reliance Broker to review the wordings of your policy and then apply that language and percentages to your actual assets values. Analyze the deductible amount you will be responsible for before you experience a loss. Planning is the best prevention, so you are not left out in the cold when a catastrophe hits. Call today for a review of your risk, our personal lines staff will be pleased to run the numbers. Call 604.255.4616.

Sample Savings:

Also see: Earthquake Buydown

Reliance Insurance proudly serves

Burnaby and the Vancouver area