Kidnap & Ransom Insurance

While we don’t like to consider a kidnap and ransom (K&R) risk, it is an unfortunate reality in today’s world, both domestically and globally. Luckily, you have support and insurance solutions available in mitigating and managing this kind of crisis.

Kidnap & Ransom Incidents

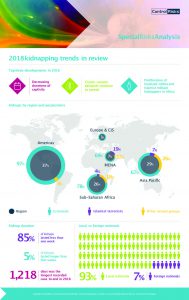

Incidents are on the rise. For example:

- Kidnappings

- Hostage takings

- Hijackings

- Extortion incidents

- Armed assaults and political evacuations

- Ransom negotiations and delivery expenses

- Other unique K&R related incidents

Credit: Clickdimensions

Insurance solutions for kidnap & ransom events

According to CoreReport, the number of war, terrorism, unrest and violent crimes being reported around the world is growing, with specific hotspots in Asia, Africa, Middle East and South America.

If you do business internationally, it is in your best interests to protect your assets from harm and a financial disaster.

An insurance solution with coverage extending to:

- the company, its directors and officers, and full-time, part-time, seasonal, leased, and temporary employees

- independent contractors

- volunteers and interns

- relatives of employees

- guests on the company’s premises or in an employee’s home

- any person retained to deliver a ransom

Reliance works with expert crisis consultancy services to help you avoid a crisis. We partner you with a coordinated coverage plan and a seamless global crisis handling solution should an event occur.

Avoid a crisis by partnering with Reliance

You may need:

Cyber Insurance

Protect your digital and financial assets against cyber attacks.

Directors & Officers

As a director or officer, protect yourself from being sued.

Key Person

Don't let the loss of a key person in your organization be the death of your business.

US and International Coverage

Create a solid foundation for your global business.

The team at Reliance Insurance has been proactive in making sure we have adequate coverage for the risks our business engages in. They've done a great job protecting our company, property and assets and ultimately our shareholders.

— Zurich Insurance

Discover Expert Advice to Protect What Matters Most!

May 13, 2025

Thrive During Cross Border Disruptions

Looking to new markets? Review your insurance Getting ahead in business requires the ability to adapt quickly to threats, opportunities, and changes in the marketplace. […]

May 1, 2025

Cyber Bytes: What Is a Zero-Click Attack?

You know not to click on sketchy links and attachments, but what about hacks that invade your device without interacting directly with you? Zero-click threats […]

April 29, 2025

Effective Ways To Regain Your Focus

Even with a strong determination to focus, your mind will wander. The brain adapted to scan its surroundings as a defense mechanism. For most of […]

Reliance Insurance proudly serves

Burnaby and the Vancouver area