We have had numerous inquiries from our commercial clients as to possible available coverage in light of the news we are seeing over the Corona (COVID19) virus outbreak and recently announced pandemic. The short answer is dependant on the type of insurance you currently hold for various risks.

What type of insurance coverage is available for COVID19?

The questions center around a possible shutdown of business due to quarantine or Government actions to prevent the spread of the virus and whether or not there may be coverage available for lost profits, employee wages etc.

The short answer is no. An insurance policy on property insures property and not the health and wellbeing of persons.

What does business interruption insurance cover?

Business interruption loss, which insures business profits, is only triggered and can pay when a risk insured against (or peril) occurs and is covered under your policy of insurance. Perils such as fire, water damage are typical losses which, if covered, trigger business interruption loss coverages.

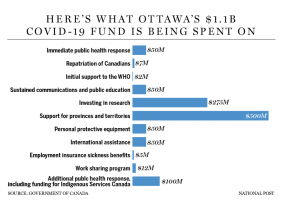

Although unfortunate for most businesses should they have to shut down because of this current COVID 19 health situation, this is not insurable. However, recent announcements from our Canadian Federal Government will provide some relief for employees and businesses with $1,000,000,000 being made available for this initiative. More details will unfold over the next days and weeks on this.

In the meantime, please take every precaution to control the risk and avoid exposure. There are many websites such as Health Canada that provide such information. We urge you to seek out information.

Contact Reliance and speak to an insurance expert if you have any coverage-related questions.

RESOURCES

Government of Canada: Takes Action on COVID 19

Government of Canada: Coronavirus Update

HealthLink BC: Coronavirus disease (COVID-19)

Reliance Insurance proudly serves

Burnaby and the Vancouver area