Construction contractors, both general and sub-trade, face a wide variety of exposures in their work, which requires an insurance program that protects the company and owners against the multitude of possible concerns and claims. At the least, contractors should carry an appropriate construction insurance such as a general liability policy.

Required construction contractors insurance coverage

General liability insurance is a requirement for a contractor, and it is crucial that the construction insurance policy provide appropriate coverage as most of your clients will require proof of insurance.

There are a number of aspects of construction insurance for contractors to consider:

Contractors’ equipment coverage will protect your equipment wherever it is located

Project-specific coverage will protect new construction, including the new building during the construction period, and can protect you from loss of income, soft cost, testing of permanent equipment (elevators), etc.

Project-specific liability insurance, also known as Wrap Up Liability Insurance, which will protect all parties connected to the project.

Protect against environmental risks

There are also environmental risks that should be addressed in your coverage:

- Fuel storage tanks

- Off-premises spills on projects or third party sites

- Asbestos and/or mold removal

Don’t become a cautionary tale in the trades: get the right construction contractors insurance

A general contractor assumes huge responsibility with each construction project they oversee. In these litigious times, a general contractor can’t afford to take risks that could lead to third-party claims and lawsuits. Not only should general contractors carry the right construction insurance coverage, so should the sub-contractors and the property owners.

The number of potential problems occurring on a job site can almost be too numerous to mention. Even a simple renovation project can go sideways should a spike accidentally impale a water pipe, or a sub-contractor’s employee is injured on the job. Theft of expensive equipment and tools can also derail a project causing down time and headaches. Factor in unlicensed and uninsured sub-contractors, and the results could spell disaster and financial ruin.

Think comprehensive for protection of assets and reputation

Construction businesses can protect their assets from a laundry list of calamities with a comprehensive construction contractor insurance package. Keep the paperwork simple with a multi feature insurance plan that boasts broad coverage because a construction project encompasses so many “working parts” that need protection.

- Commercial general liability insurance (CGL) protects construction businesses in the event they are found legally liable for bodily injury or property damage due to work that the business performed. CGL insurance also covers accidents/ injuries to visitors at the business premise and the job site, as well as completed operations coverage.

- Another liability option for construction contractors to consider is Wrap-Up Insurance for “catch all” liability covering the whole operation. A Wrap-Up insurance policy includes the project owners and the sub-contractors as well.

- Property insurance will cover a construction business’s owned or leased buildings and structures, computers and software, machinery, mobile equipment, signs and fences and employee salaries/payroll in the event of fire, theft and other threats.

- Commercial auto insurance provides protection for construction businesses with a dedicated work vehicle or fleet of vehicles.

- Equipment breakdown insurance with enhanced coverage offers protection against a variety of equipment breakdown issues that may occur on premise, on-site, or in-transit between the two.

- Surety Bonds for bids, contractor performance, labour and material payment will add another layer of protection for both the client and the contractor.

“Reliance Insurance has been our broker for over 10 year. We are extremely pleased with their service. They handle claims very professionally and make dealing with our insurance needs pain free and even pleasurable. Selecting Reliance as our broker was one the best decisions we have made.”

Controller, Frontier Power Products Ltd.

Sub-contractors: reinforce your reputation with the right insurance coverage

According to the British Columbia Construction Association‘s statistics, construction has been ranked as the number one employer in British Columbia every year, for the last five years. A whopping 92 percent of the construction companies in BC have less than 20 employees. With all of these small construction businesses competing for a piece of the pie, it makes sense for these businesses to reinforce their reputations with construction contractor insurance.

Sub-contractors that cover their businesses with a comprehensive insurance plan will instill confidence in those who do the hiring. Nowadays, it’s not enough to be at the top of the game in terms of skill, quality workmanship and the ability to work under pressure. A successful, small construction business has to also stand out as a responsible, accountable, completely insured contractor that offers peace of mind.

There are many considerations for a contractor. At Reliance Insurance, we can provide a thorough review of your operations, projects under way and future projects and related insurance requirements. Use our expertise to ensure that you and your project have the necessary protection.

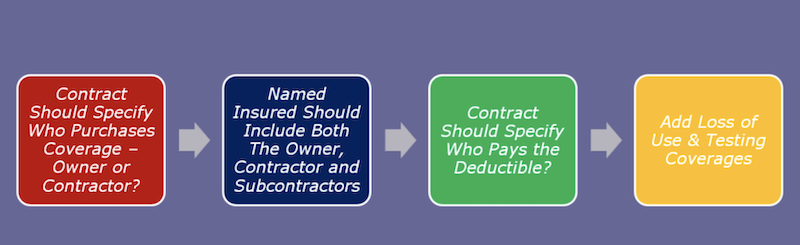

Builders Risk Insurance

Links and resources for construction contractors insurance

BC Construction Association Stats

Aviva – A Reliance Insurance partner for construction insurance

City of Vancouver Road Closures and Construction

Burnaby Road Closures and Obstructions

Reliance Insurance proudly serves

Burnaby and the Vancouver area