Commercial insurance coverage related to COVID19

All of us at Reliance extend our deepest sympathies to all those affected and their families. This is a surreal time. We are committed to being available to support your personal and business insurance needs, as well as our communities through this unprecedented event. To do so we are enabling our team to care for themselves and their families with opportunities to work remotely. Our offices remain open, but we have asked staff to curtail in-person meetings and any business travel. We’re all in this together, we’re here for you in as much as we can be, and one way or another we will all get through this by working together.” Chris Ball, CEO

On the insurance front

We have had numerous inquiries from our commercial clients as to possible available coverage in light of the news we are seeing over the Corona (COVID) virus outbreak and recently announced pandemic.

What type of insurance coverage is available for COVID19?

The questions center around a possible shutdown of business due to quarantine or Government actions to prevent the spread of the virus and whether or not there may be coverage available for lost profits, employee wages, etc.

The short answer is no. An insurance policy on property insures property and not the health and wellbeing of persons.

What does business interruption insurance cover?

Business interruption loss, which insurers a business’s profits, is only triggered and can pay when a risk insured against (or peril) occurs and is covered under your policy of insurance. Perils such as fire, water damage are typical losses which, if covered, trigger business interruption loss coverage’s.

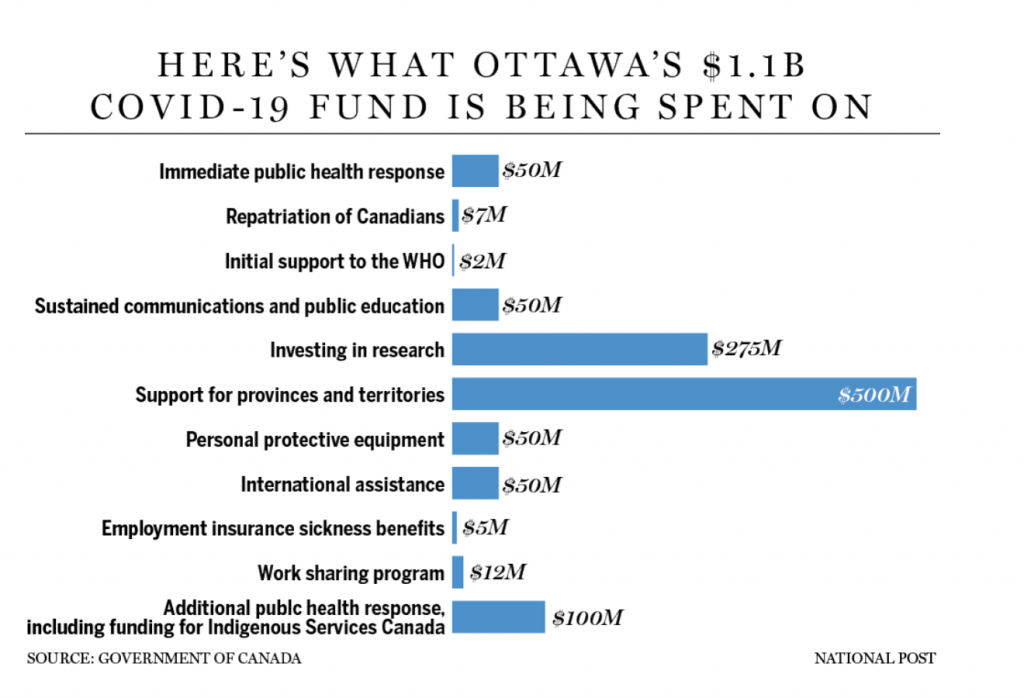

Although unfortunate for most businesses should they have to shut down because of this current COVID 19 health situation, this is not insurable. However, recent announcements from our Canadian Federal Government will provide some relief for employees and businesses with $1,000,000,000 being made available for this initiative. More details will unfold over the next days and weeks on this.

Northbridge updates coverages

With the declaration of COVID-19 as a pandemic by the World Health Organization, current policyholders with Outbreak Extra Expense under our Commercial Property and Business Interruption forms are now eligible for this coverage, subject to terms of this wording. This provides coverage for extra expenses only; it does not cover income loss. There is a $10,000 default policy aggregate.

If an emergency declaration is made by a Canadian public authority, and if you’re unable to reach customers who have been directly impacted by the pandemic outbreak and whose policy expiry date is approaching, we will “hold covered” on policies in force at the time of the declaration. This emergency declaration will be considered underway until we advise otherwise. A coverage extension will be read in for impacted customers, subject to terms of this wording and the limits and coverage in force at the time the declaration was made.

In the meantime, please take every precaution to control the risk and avoid exposure. There are many, many websites such as Health Canada that provide such information. We urge you to seek out information.

RESOURCES

Northbridge Insurance: COVID Resources

Government of Canada: Takes Action on COVID 19

Government of Canada: Coronavirus Update

HealthLink BC: Coronavirus disease (COVID-19)

© Copyright 2024 Reliance Insurance Agencies Ltd. All Rights Reserved.