Liability coverages & risk management during the Covid 19 pandemic

Although, we have heard it more than we all like, the insurance industry is heading into uncharted territory. Now that communities, services, stores and the economy in general is starting to open up we are getting many questions regarding liability coverages and risk management. What type of liability coverage is available for issues related to a pandemic? What is my risk of being sued? A good risk management strategy is always a good way to move any business forward, and now is the time to update yours to protect your staff and your business.

Can I be sued for damages related to Covid-19?

The Reliance Insurance risk management team and claims specialists are keeping a close eye on what is happening not only in Canada but around the world related to risk management and liability. No doubt in more litigious countries there will be claims and lawsuits, but no one can speculate on how lawyers may state their case for the injured party. We are in new territory that has not been tested in the court of law.

There are many issues at stake. First is the policy wordings itself. Many insurance policies have force majeure clauses. Second is the liability coverage and third is negligence.

In Canadian tort law (common law) a claim or lawsuit has to state and prove negligence by the defendant. The liability insurer has the “duty to defend” and will hire lawyers to do just that. The short answer is yes, any company could get sued but this a different issue all together to sue successfully and get the money from the insured.

Create a risk management plan specific to the pandemic

A best defence is a well-thought out and implemented offense. Create and practice risk management strategies that will help prevent being sued in the first place. In the case of Covid-19 Pandemic it is critical that a company and the leadership follow the protocols set out by the provincial, federal and local health authorities for safely operating a business.

As insurance brokers we recommend the following as part of your risk management plan:

Follow the guidelines and proper procedures for social distancing and sanitization, and keep documented proof:

1. Follow the rules for social distancing.

2. Stay current on what authorities such as Dr. Bonnie Henry are recommending about the pandemic and business operations and adhere to the changing guidelines and rules.

3. If you are going to re-open to the public, clean and disinfect thoroughly following guidelines before opening and then maintain recommended guidelines after opening and receiving customers. Keep a log of your cleaning schedules.

4. Install proper and sufficient warning and rules signage outside entry points and inside your premises. Avoid going over your recommended number of people on the premises.

5. Diligently train your staff and put in standardized protocols to ensure they are following the rules.

6. To defend against claims, or successfully defend a lawsuit; keep records, logs including photos and videos of your cleaning and disinfecting and social distancing measures and schedules. Keep receipts and order logs for PPE and cleaning supplies.

Safely open up your business

Although there are many unknowns going into phase 2 and 3 of the economy opening up, as a business operator you can manage your risk. Many industries have associations who have worked tirelessly to develop protocols. Utilize the resources from associations, health authorities and your Reliance Insurance risk management specialist. We have many free resources to share with our clients.

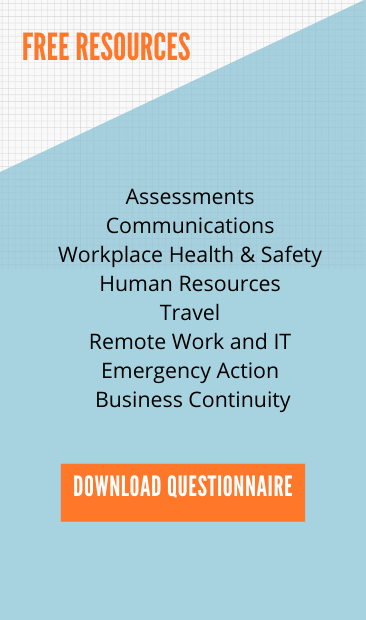

Covid-19 Response Questionnaire

As a result of the unprecedented challenges the COVID-19 pandemic brings, businesses

should review their protocols to ensure they are doing all they can to protect their

workforce and manage their operations. Thankfully, assessing your exposures and

taking the appropriate precautions can go a long way toward safeguarding your business. We have provided a free resource questionnaire giving businesses the opportunity to review categories specific to COVID-19 and take actions to address those risks. For a risk audit for your business contact our commercial insurance risk advisors at 604.255.4616

Additional Resources

Manufacturing Safety Alliance: Covid-19 Safety Assessment

Worksafe BC: Industry specific restart plans

Insurance Bureau of Canada: COVID-19: Canadian home, auto and business insurance information

© Copyright 2024 Reliance Insurance Agencies Ltd. All Rights Reserved.